The EU and its financial institutions have been pushing an austerity policy on Greece for the last five years. High unemployment, more taxes, billions of euros fleeing, and an increase in suicides mean Greeks on Sunday have to decide if enough is enough.

What happened?

In January, the left-wing Syriza party led by Prime Minister Alexis Tsipras promised to end years of austerity measures without leaving the eurozone.

What went wrong?

Greek debt negotiations have been fruitless for five months. Creditors wanted economic reforms in return for bailout money, but Syriza refused to budge on key election promises.

RT shows you what has happened to the Greek economy during the era of austerity.

1 – “In five years in Greece, we have cut pensions by 44 percent, reduced private sector pay by 32 percent, destroyed the job market, smashed the welfare state, bled employees and the middle class dry with taxes, and reached one and a half million unemployed in a country with an active population of six million,” Alexis Tsipras said in an interview with an Italian newspaper Corriere della Sera.

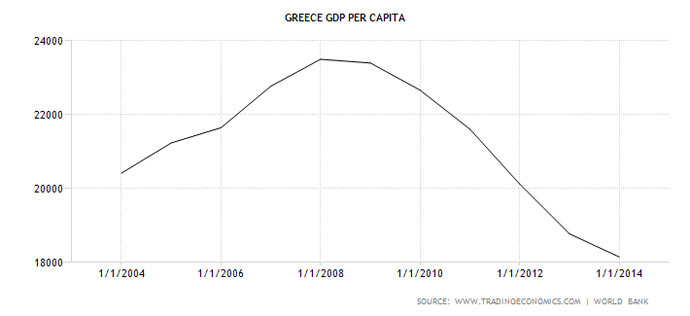

2 – Greek GDP per capita has fallen to $21,700 in 2014 from $26,900 in 2010 in current US dollars, World Bank data suggests.

3 – Youth unemployment has reached more than 50 percent. Around 55 percent of those unemployed are under 35, according to UK entrepreneurship charity Endeavour.

4 – 44.8 percent of Greek pensioners are living below the poverty line. Their pensions amount to no more than €665 and have been cut 44-48 percent since 2010.

5 – The Greek suicide rate jumped 35 percent during the peak of the crisis in 2011 and 2012. Almost 80 percent of the suicides were men. Greece’s rate used to be the lowest in Europe, but it soared during the crisis.

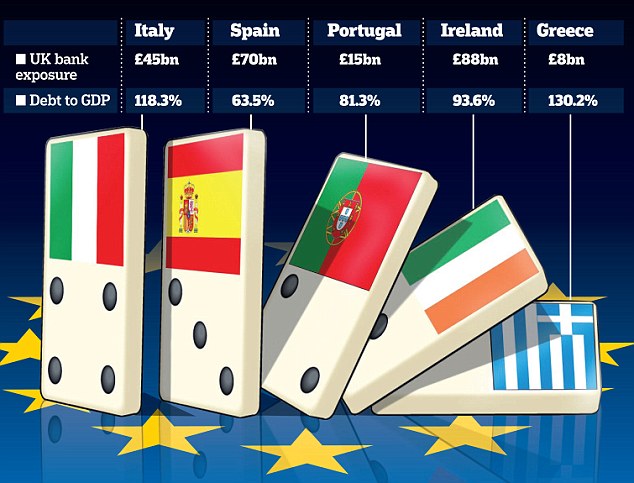

6 – The Bank of England has warned that the Greek debt crisis is a threat to the UK’s financial stability and could trigger wider problems for financial markets. The market value of European banks shrunk by more than €50 billion on July 29, when the Greek government closed banks across the country and limited daily cash withdrawals to €60.

RELATED ARTICLES

- EU conservative leaders Meet in Romania for Reelection and Victory lap

- EU Approves Digital ID, Greece Becomes First to Adopt the Law

- Egyptian gunman shoots dead 3 ex-coworkers at Greek shipping company

- Martial Law declared in Shanghai, city plagued by Mass Arrests and Suicides

- Seniors to be fined for violating vaccine mandate